Convertible bond

| Financial markets |

|---|

|

Exchange |

| Bond market |

|

Fixed income |

| Stock market |

|

Stock |

| Derivatives market |

|

Securitization |

| OTC, non organized |

|

Spot market |

| Foreign exchange |

|

|

| Other markets |

|

Money market |

| Practical trading |

|

Participants |

|

Finance series |

In finance, a convertible note (or, if it has a maturity of greater than 10 years, a convertible debenture) is a type of bond that the holder can convert into shares of common stock in the issuing company or cash of equal value, at an agreed-upon price. It is a hybrid security with debt- and equity-like features. Although it typically has a low coupon rate, the instrument carries additional value through the option to convert the bond to stock, and thereby participate in further growth in the company's equity value. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments.

From the issuer's perspective, the key benefit of raising money by selling convertible bonds is a reduced cash interest payment. However, in exchange for the benefit of reduced interest payments, the value of shareholder's equity is reduced due to the stock dilution expected when bondholders convert their bonds into new shares.

The convertible bond markets in the United States and Japan are of primary global importance. These two domestic markets are the largest in terms of market capitalisation. Other domestic convertible bond markets are often illiquid, and pricing is frequently non-standardised.

- USA: It is a highly liquid market compared to other domestic markets. Domestic investors have tended to be most active within US convertibles

- Japan: In Japan, the convertible bond market is more regulated than other markets. It consists of a large number of small issuers.

- Europe: Convertible bonds have become an increasingly important source of finance for firms in Europe. Compared to other global markets, European convertible bonds tend to be of high credit quality.

- Asia (ex Japan): The Asia region provides a wide range of choice for an investor. The maturity of Asian convertible bond markets vary widely.

- Canada: Canadian convertible bonds are exchange traded. Most of the Canadian convertible bond market consists of unsecured sub-investment grade bonds with high yields that are reflective of the issuer's risk of default.[1]

- Domestics versus Euroconvertible bonds A further important classification is between the domestic and euroconvertibles markets. Euroconvertibles pay their interest gross and are free of transfer duty when bought, and are delivered into Euroclear or Clearstream for 7 day settlement. Domestics may have different settlement dates, they may pay their interest net of tax and be subject to transaction taxes. European euroconvertibles are generally highly liquid and have a pan-European investor base, dominated by hedge funds and proprietary desks. European domestic convertibles (such as in the UK and Italy) are dominated more by local investment institutions. Since the early nineteen-eighties, foreigners have been able to receive interest on U.S. domestic convertible bonds gross, and this has broadened the global investor base to embrace global hedge funds and other global investors. Likewise, foreigners have been able to receive interest gross on French convertibles (obligations convertibles or OCs), further blurring the differentiation between the domestic and euro CB markets. The pan-European CB market has substantially replaced the various domestic CB markets, and the driver behind this has been the ability of cross-border investors to receive interest payments gross.

Contents |

Structure and features

Like any typical bond, convertible bonds have an issue size, issue date, maturity date, maturity value, face value and coupon. They also have the following additional features:

- Conversion price: The nominal price per share at which conversion takes place.

- Conversion ratio: The number of shares each convertible bond converts into. It may be expressed per bond or on a per centum (per 100) basis.

- Parity (Conversion) value: Equity price × Conversion ratio.

- Conversion premium: Represent the divergence of the market value of the CB compared to that of the parity value.

- Call features: The ability of the issuer (on some bonds) to call a bond early for redemption, sometimes subject to certain share price performance. The intention is to encourage investors to convert early into equity (which has now become worth more than the bond's face value), by threatening repayment in cash for what is now a lower amount.

Types

There are many variations of the basic structure of a convertible bond.

- Vanilla convertible bonds are bonds which may be converted at the option of the owner into the shares of the issuer, usually at a pre-determined rate. They may or may not be redeemable by the issuer prior to the final maturity date, subject to certain share price performance conditions.

- Exchangeables (XB) are bonds which may be exchanged into shares other than those of the issuer. Strictly speaking, they are not convertibles, but they share certain common evaluation characteristics.

- Mandatory convertibles are short duration securities—generally with yields higher than found on the underlying common shares — that are mandatorily convertible upon maturity into a fixed number of common shares. If it is intended to provide a minimum value for the convertible at maturity, convertibility may be into a sufficient number of shares based on the stock price at maturity to provide that minimum redemption value.

- Mandatory exchangeables are short duration securities—generally with yields higher than found on the underlying common shares — that are mandatorily exchangeable upon maturity into a fixed number of common shares. Likewise, if it is intended to provide a minimum value for the convertible at maturity, exchange may be into a sufficient number of shares (based on the stock price at maturity) to provide that minimum redemption value. Such exchangeables may be said to be "redeemed into equity", and care should be taken when reading the offering documentation, lest "redemption" and "conversion" are confused.

- Contingent convertibles (co-co) only allow the investor to convert into stock if the price of the stock is a certain percentage above the conversion price. For example, a contingent convertible with a $10 stock price at issue, 30% conversion premium and a contingent conversion trigger of 120%, can be converted (at $13) only if the stock trades above $15.60 ($13 x 120%) over a specified period, often 20 out of 30 days before the end of the quarter.

- The co-co feature was often favored by issuers because the shares of underlying common stock were only required to be included in diluted EPS calculation if the issuer's stock traded above the contingent conversion price. In contrast, non-co-co convertible bonds result in an immediate increase in diluted shares outstanding, thereby reducing the EPS. The impact to diluted shares outstanding is calculated using the "as-if-converted" method, which requires the most conservative EPS value be used. Recent changes to GAAP have eliminated the favorable treatment of co-co's, and as a result their popularity with issuers has waned.

- OCEANEs (or Obligation Convertible En Actions Nouvelles ou Existantes) are bonds which may be converted into the equity of the issuer, but the issuer has the right to deliver new shares or old shares held in Treasury (possibly with different dividend rights). They are a common structure for French issues. These bonds are technically not convertibles, as defined by the law of 25 February 1953. Consequently, there is no three-month conversion period for investors following the date that bonds called are due for redemption, (as is otherwise required, under French law, for French convertibles).

- Convertible preferred stock, (convertible preference shares in the UK), is similar in valuation to a bond, but with lower seniority in the capital structure. Non-payment of income is generally not regarded as an act of default by the issuer. The terms of each issue will define whether or not entitlement to unpaid preference income is cumulative.

- SPV structures Many convertibles, particularly Euroconvertibles, are issued though special purpose vehicles (SPVs), (typically a subsidiary based offshore in British Virgin Islands, the Cayman Islands or Jersey). The SPV debt is convertible (exchangeable to be more precise) into the equity of the parent company, which is often a holding company. Although the parent may guarantee the SPV debt on an unsubordinated basis, the assets of a parent company could just be shares of various subsidiaries. This means that nominally unsubordinated guarantee on the debt could in fact be structurally subordinated. More significantly, the basis of seniority upon which money raised by the issuing entity has been onwardly applied is rarely revealed at issue; if on-lent on a subordinated basis, the asset quality of the issuing entity and its debt is impaired. This creates a fundamental weakness in the credit analysis of any convertible and non-convertible SPV debt.

- Reverse convertible securities are short-term coupon-bearing notes, structured to provide enhanced yield while participating in certain equity-like risks. Reverse convertibles securities are most commonly targeted towards the US market. Their investment value is derived from underlying equity exposure, which is paid in the form of fixed coupons. Generally speaking, the higher the coupon payment, the more likely it is that the investor is delivered shares on maturity. Investors receive full principal back at maturity (plus accrued interest) in cash (but no more) if the Knock-in Level is not breached at any time during the life of the security. The Knock-in level is typically 70-80% of the initial reference price. The underlying stock, index or basket of equities is defined as Reference Shares. In most cases, Reverse convertibles are linked to a single stock.

- Going-public bonds are fixed interest securities which convert or exchange into shares of a company when it later achieves a stock market listing. Distribution is initially syndicated to sub-underwriters, this distribution typically being helped by a short-term redemption feature, possibly in equity, at or near the subsequently prevailing share price. This reduces the downside risks to sub-underwriters taking bonds at issue. Some time subsequent to their issue, the bonds become convertible or exchangeable into shares, the conversion price reflecting in some measure the share price (or expected share price) at the time of conversion – and may be fixed at a discount, to encourage conversion. The key element of going-public bonds is that the primary distribution date is de-coupled from the date when the conversion or exchange price is fixed. In France a series of such bonds were known as Balladur bonds.

- Hybrid bonds typically are issued as loan capital, but the issuer retains the right to exchange or convert the bonds into convertible preference shares with similar conversion rights and income. The purpose is generally to ensure that the bonds (as loan capital) have the tax offset-ability (against taxable profits) of loan interest, and perhaps pay gross to qualifying investors. At the same time, the ability to change the bonds into cumulative or non-cumulative preference capital should mean that they pose less balance sheet risk. The issuer only achieves the best of both worlds if the hybrid bond is structured so that non-payment of interest does not constitute an event of default.

Valuation

In theory, the market price of a convertible debenture should never drop below its intrinsic value. The intrinsic value is simply the number of shares being converted at par value times the current market price of common shares.

The 3 main stages of convertible bond behaviour are:

- In-the-money convertible bonds

- At-the-money convertible bonds

- Out-the-money

- In-the-money: Conversion Price is < Equity Price.

- At-the-money: Conversion Price is = Equity Price.

- Out-the-money: Conversion Price is > Equity Price.

- In-the-money CB's are considered as being within Area of Equity (the right hand side of the diagram)

- At-the-money CB's are considered as being within Area of Equity & Debt (the middle part of the diagram)

- Out-the-money CB's are considered as being within Area of Debt (the left hand side of the diagram)

From a valuation perspective, a convertible bond consists of two assets: a bond and a warrant. Valuing a convertible requires an assumption of

- the underlying stock volatility to value the option and

- the credit spread for the fixed income portion that takes into account the firm's credit profile and the ranking of the convertible within the capital structure.

Using the market price of the convertible, one can determine the implied volatility (using the assumed spread) or implied spread (using the assumed volatility).

This volatility/credit dichotomy is the standard practice for valuing convertibles. What makes convertibles so interesting is that, except in the case of exchangeables (see above), one cannot entirely separate the volatility from the credit. Higher volatility (a good thing) tends to accompany weaker credit (bad). In the case of exchangeables, the credit quality of the issuer may be decoupled from the volatility of the underlying shares. The true artists of convertibles and exchangeables are the people who know how to play this balancing act.

A simple method for calculating the value of a convertible involves calculating the present value of future interest and principal payments at the cost of debt and adds the present value of the warrant. However, this method ignores certain market realities including stochastic interest rates and credit spreads, and does not take into account popular convertible features such as issuer calls, investor puts, and conversion rate resets. The most popular models for valuing convertibles with these features are finite difference models such as binomial and trinomial trees.

- Binomial valuations Since 1991-92, most market-makers in Europe have employed binomial models to evaluate convertibles. Models were available from the London Business School, Trend Data of Canada, Bloomberg LP and from home-developed models, amongst others.

- These models needed an input of credit spread, volatility for pricing (historic volatility often used), and the risk-free rate of return. The binomial calculation assumes there is a bell-shaped probability distribution to future share prices, and the higher the volatility, the flatter is the bell-shape. Where there are issuer calls and investor puts, these will affect the expected residual period of optionality, at different share price levels. The binomial value is a weighted expected value, (1) taking readings from all the different nodes of a lattice expanding out from current prices and (2) taking account of varying periods of expected residual optionality at different share price levels.

- The three biggest areas of subjectivity are (1) the rate of volatility used, for volatility is not constant, and (2) whether or not to incorporate into the model a cost of stock borrow, for hedge funds and market-makers. The third important factor is (3) the dividend status of the equity delivered, if the bond is called, as the issuer may time the calling of the bond to minimise the dividend cost to the issuer.

Uses for investors

- Convertible bonds are usually issued offering a higher yield than obtainable on the shares into which the bonds convert.

- Convertible bonds are safer than preferred or common shares for the investor. They provide asset protection, because the value of the convertible bond will only fall to the value of the bond floor. At the same time, convertible bonds can provide the possibility of high equity-like returns.

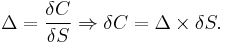

- Also, convertible bonds are usually less volatile than regular shares. Indeed, a convertible bond behaves like a call option. Therefore, if C is the call price and S the regular share then

In consequence, since  we get

we get  , which implies that the variation of C is less than the variation of S, which can be interpreted as less volatility.

, which implies that the variation of C is less than the variation of S, which can be interpreted as less volatility.

- The simultaneous purchase of convertible bonds and the short sale of the same issuer's common stock is a hedge fund strategy known as convertible arbitrage. The motivation for such a strategy is that the equity option embedded in a convertible bond is a source of cheap volatility, which can be exploited by convertible arbitrageurs.

- In limited circumstances, certain convertible bonds can be sold short, thus depressing the market value for a stock, and allowing the debt-holder to claim more stock with which to sell short. This is known as death spiral financing.

Redemption Options/Strategies

- Soft put - can be redeemed for cash, stock or notes or a combination of all three at the company's discretion.

- Hard put - payable only in cash

- Protective put - buying a put option for the underlying bond security

- Subordinated put -

- Convertible put - convert to share by paying a charge

Uses for issuers

- Lower fixed-rate borrowing costs. Convertible bonds allow issuers to issue debt at a lower cost. Typically, a convertible bond at issue yields 1% to 3% less than straight bonds.

- Locking into low fixed–rate long-term borrowing. For a finance director watching the trend in interest rates, there is an attraction in trying to catch the lowest point in the cycle to fund with fixed rate debt, or swap variable rate bank borrowings for fixed rate convertible borrowing. Even if the fixed market turns, it may still be possible for a company to borrow via a convertible carrying a lower coupon than ever would have been possible with straight debt funding.

- Higher conversion price than a rights issue strike price. Similarly, the conversion price a company fixes on a convertible can be higher than the level that the share price ever reached recently. Compare the equity dilution on a convertible issued on, say, a 20 or 30pct premium to the higher equity dilution on a rights issue, when the new shares are offered on, say, a 15 to 20pct discount to the prevailing share price.

- Voting dilution deferred. With a convertible bond, dilution of the voting rights of existing shareholders only happens on eventual conversion of the bond. However convertible preference shares typically carry voting rights when preference dividends are in arrears. Of course, the bigger voting impact occurs if the issuer decides to issue an exchangeable rather than a convertible.

- Increasing the total level of debt gearing. Convertibles can be used to increase the total amount of debt a company has in issue. The market tends to expect that a company will not increase straight debt beyond certain limits, without it negatively impacting upon the credit rating and the cost of debt. Convertibles can provide additional funding when the straight debt “window” may not be open. Subordination of convertible debt is often regarded as an acceptable risk by investors if the conversion rights are attractive by way of compensation.

- Maximising funding permitted under pre-emption rules. For countries, such as the UK, where companies are subject to limits on the number of shares that can be offered to non-shareholders non-pre-emptively, convertibles can raise more money than via equity issues. Under the UK’s 1989 Guidelines issued by the Investor Protection Committees (IPCs) of the Association of British Insurers (ABI) and the National Association of Pension Fund Managers (NAPF), the IPCs will advise their members not to object to non pre-emptive issues which add no more than 5pct to historic non-diluted balance sheet equity in the period from AGM to AGM, and no more than 7.5pct in total over a period of 3 financial years. The pre-emption limits are calculated on the assumption of 100pct probability of conversion, using the figure of undiluted historic balance sheet share capital (where there is assumed a 0pct probability of conversion). There is no attempt to assign probabilities of conversion in both circumstances, which would result in bigger convertible issues being permitted. The reason for his inconsistency may lie in the fact that the Pre Emption Guidelines were drawn up in 1989, and binomial evaluations were not commonplace amongst professional investors until 1991-92.

- Premium redemption convertibles such as the majority of French convertibles and zero-coupon Liquid Yield Option Notes (LYONs) , provide a fixed interest return at issue which is significantly (or completely) accounted for by the appreciation to the redemption price. If, however, the bonds are converted by investors before the maturity date, the issuer will have benefited by having issued the bonds on a low or even zero-coupon. The higher the premium redemption price, (1) the more the shares have to travel for conversion to take place before the maturity date, and (2) the lower the conversion premium has to be at issue to ensure that the conversion rights are credible.

- Takeover paper. Convertibles have a place as the currency used in takeovers. The bidder can offer a higher income on a convertible that the dividend yield on a bid victim’s shares, without having to raise the dividend yield on all the bidder’s shares. This eases the process for a bidder with low-yield shares acquiring a company with higher-yielding shares. Perversely, the lower the yield on the bidder’s shares, the easier it is for the bidder to create a higher conversion premium on the convertible, with consequent benefits for the mathematics of the takeover. In the 1980’s, UK domestic convertibles accounted for about 80pct of the European convertibles market, and over 80pct of these were issued either as takeover currency or as funding for takeovers. They had several cosmetic attractions.

- The pro-forma fully-diluted earnings per share shows none of the extra cost of servicing the convertible up to the conversion day irrespective of whether the coupon was 10pct or 15pct. The fully diluted earnings per share is also calculated on a smaller number of shares than if equity was used as the takeover currency.

- In some countries (such as Finland) convertibles of various structures may be treated as equity by the local accounting profession. In such circumstances, the accounting treatment may result in less pro-forma debt than if straight debt was used as takeover currency or to fund an acquisition. The perception was that gearing was less with a convertible than if straight debt was used instead. In the UK the predecessor to the International Accounting Standards Board (IASB) put a stop to treating convertible preference shares as equity. Instead it has to be classified both as (1) preference capital and as (2) convertible as well.

- Nevertheless, none of the (possibly substantial) preference dividend cost incurred when servicing a convertible preference share is visible in the pro-forma consolidated pretax profits statement.

- The cosmetic benefits in (1) reported pro-forma diluted earnings per share, (2) debt gearing (for a while) and (3) pro-forma consolidated pre-tax profits (for convertible preference shares) led to UK convertible preference shares being the largest European class of convertibles in the early 1980s, until the tighter terms achievable on Euroconvertible bonds resulted in Euroconvertible new issues eclipsing domestic convertibles (including convertible preference shares) from the mid 1980s.

- Tax advantages. The market for convertibles is primarily pitched towards the non taxpaying investor. The price will substantially reflect (1) the value of the underlying shares, (2) the discounted gross income advantage of the convertible over the underlying shares, plus (3) some figure for the embedded optionality of the bond. The tax advantage is greatest with mandatory convertibles. Effectively a high tax-paying shareholder can benefit from the company securitising gross future income on the convertible, income which it can offset against taxable profits.

2007 YTD Global Equity-Linked Underwriting League Table

| Rank | Underwriter | Market Share (%) | Amount ($m) |

|---|---|---|---|

| 1 | JP Morgan | 14.5 | $22,111.77 |

| 2 | Citi | 11.8 | $18,068.55 |

| 3 | Merrill Lynch | 8.8 | $13,487.20 |

| 4 | Deutsche Bank | 8.1 | $12,312.37 |

| 5 | Morgan Stanley | 7.6 | $11,594.01 |

| 6 | UBS | 6.2 | $9,481.37 |

| 7 | Credit Suisse | 5.1 | $7,746.64 |

| 8 | Lehman Brothers | 4.7 | $7,132.62 |

| 9 | Goldman Sachs | 4.6 | $7,076.09 |

| 10 | UBS | 3.9 | $6,000.78 |

Source: Bloomberg

2006 Global Equity-Linked Underwriting League Table

| Rank | Underwriter | Market Share (%) | Amount ($m) |

|---|---|---|---|

| 1 | Citi | 14.4 | $18,479.25 |

| 2 | Merrill Lynch | 10.1 | $12,993.69 |

| 3 | Morgan Stanley | 9.1 | $11,686.02 |

| 4 | JP Morgan | 6.4 | $8,194.18 |

| 5 | Deutsche Bank | 6.3 | $8,127.95 |

| 6 | UBS | 6.2 | $7,973.50 |

| 7 | Goldman Sachs | 6.1 | $7,845.25 |

| 8 | Lehman Brothers | 6.0 | $7,662.31 |

| 9 | Bank of America | 5.0 | $6,458.32 |

| 10 | Nomura | 4.4 | $5,336.98 |

Source: Bloomberg

See also

- Convertible preferred stock

- Convertible security

- Convertible Bonds on Wikinvest

- Exchangeable bond

References

- ↑ "Introduction to Canadian Convertible Debentures". Voya Vasiljevic, ScotiaMcLeod. March 13, 2009. http://www.ritceyteam.com/pdf/IntroToConverts_ClientFriendly.pdf. Retrieved March 13, 2009.

External links

- Pricing Convertible Bonds using Partial Differential Equations - by Lucy Li

- Pricing Inflation-Indexed Convertible Bonds - by Landskroner and Raviv

- Convertible Bond

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||||